Award-winning PDF software

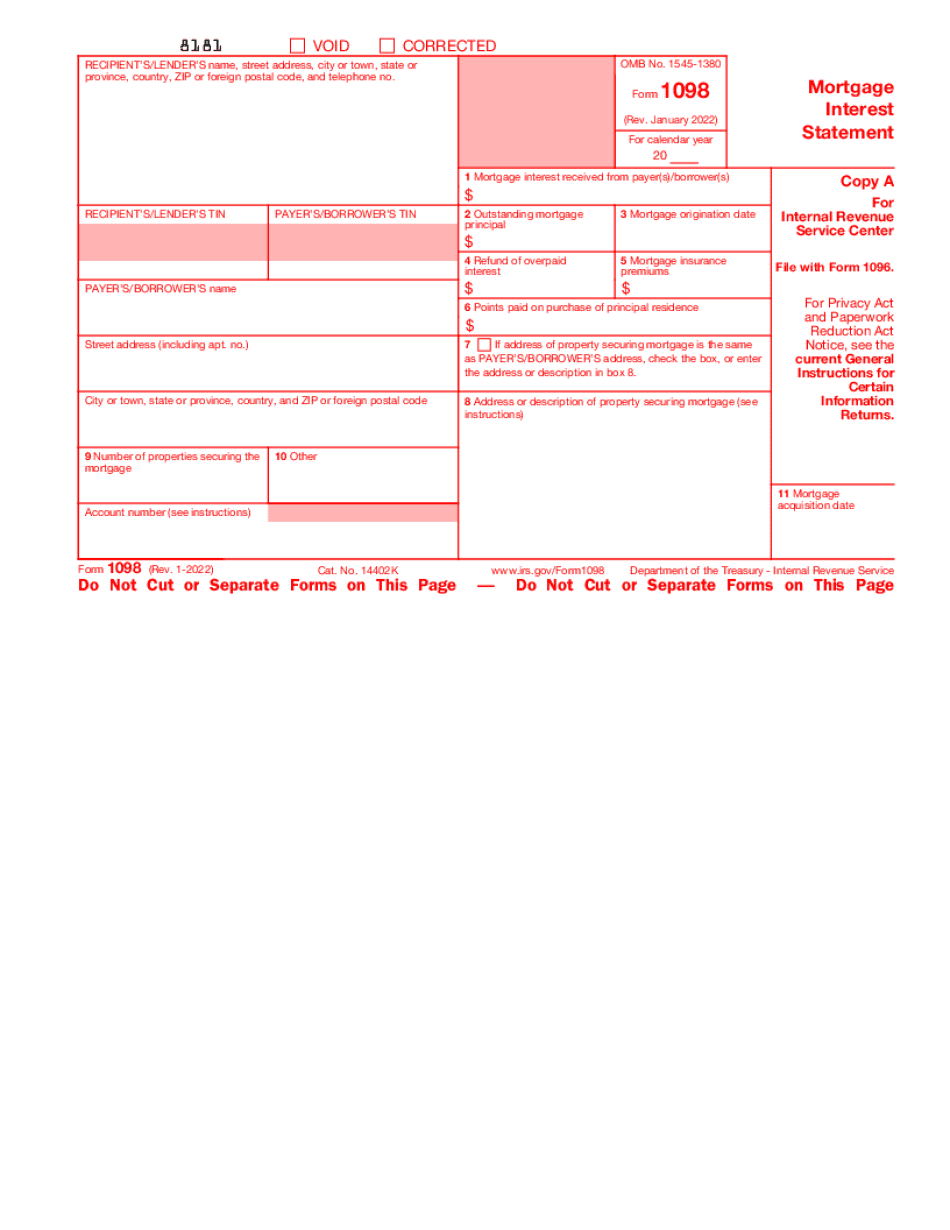

MI Form 1098: What You Should Know

Tuition Incentive Tax Credit, Hope Scholarship Tax Credit and Free Tuition Credit. Form 1098-T. To be provided by your school It includes information on financial aid disbursements and scholarship payments Form 1098-T. To be obtained by your school's financial aid office for filing. For more information, contact the Office of the Financial Aid Office at: Taxpayers and the IRS have the right to see your tax return, report on it and get information about it — or refuse to accept it. As a student, you have a right to know your tax return — report on it and get information about it. Taxpayers have the right to access your tax return by filing Freedom of Information Act Request. By completing the application on IRS.gov's Student Access Portal, tax filers have the opportunity to ask questions, and request certain records and materials related to your personal federal tax status. To determine which IRS forms you need and whether you need them, ask your school or student financial aid office. Taxpayer Rights Each time your tax return is audited, and you appeal any problems with the result, you can ask and receive a written decision explaining the findings of the audit. As a student, you have a right to receive IRS financial aid, which is only available through a federal tax return. Generally, student loan program benefits are given subject to the IRS approval process, and all of these must be approved and completed in the same year. The IRS can deny your interest and any other financial aid in cases where other conditions are met. Student financial aid requires the IRS to approve and complete your tax return, which may result in a different IRS assessment of the amount of the student loan. For some student aid, such as the Student Loan Repayment Consolidation Loan Program, you can request an IRS ruling allowing you to qualify for certain financial aid. Some schools and student financial aid departments are involved in processing student aid. This would include a student's student account and the school's student account. Generally, a student must return to a school or office where he or she filed for graduation. Student financial aid and the IRS can share your information in many ways. The tax forms 1098-T are used to identify taxpayers and their educational expenses. These forms may be used by financial aid officials, school officials, tax authorities and others.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete MI Form 1098, keep away from glitches and furnish it inside a timely method:

How to complete a MI Form 1098?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your MI Form 1098 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your MI Form 1098 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.