Award-winning PDF software

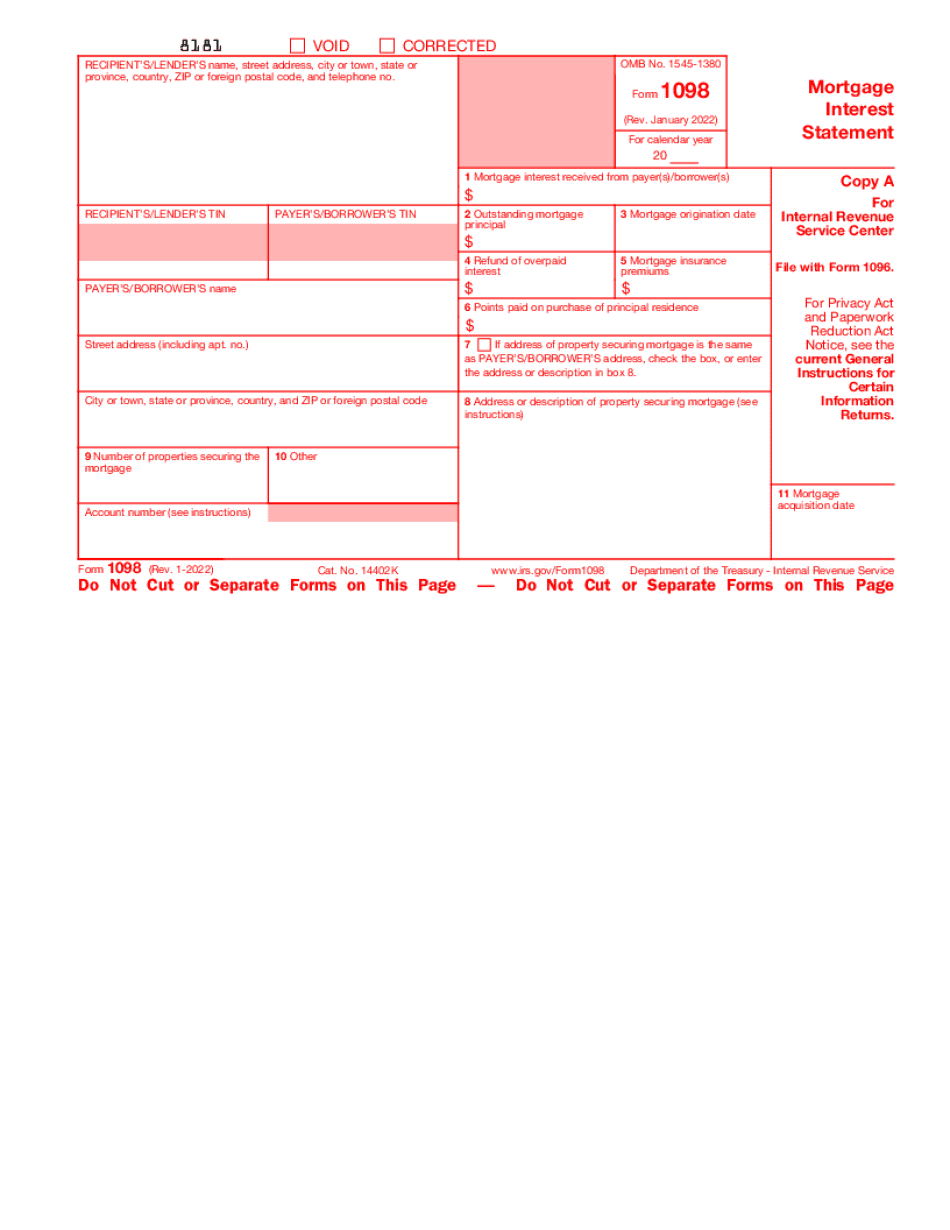

Iowa online Form 1098: What You Should Know

To download the form, click on “1098-T” in the upper left-hand corner. To find out if the person is or is not a resident of the USA, we can use a copy of the Individual Taxpayer Identification Number (ITIN), also known as a social security number. The number is normally issued by the Social Security Administration and is used by the IRS to determine the citizenship status of taxpayers in various situations. We obtain such information in a variety of ways: From student records (at U.S. high schools and colleges) using the IP UMS (International Postsecondary Student Information System). From U.S. Department of State passports, when applying for a visa to the United States. If an International visa is issued, the U.S. consulate will issue the IP UMS number, even if the visa is not valid. From the IP UMS itself. If a student at a U.S. school or college does not have an IP UMS number, the IP UMS will generate a unique one for them. These numbers are available only to students, their parents, or their guardians. In general, student records are very unreliable, and the information they contain may be very incomplete. Please use your own best judgment when applying for a U.S. visa if you are not aware of the information that the government may have concerning your immigration background. More information on the “1098-T” may be found here. 1098-T and Foreign Earned Income Under the tax code, any income that you are not taxed on because your parents are nonresident aliens is foreign earned income. The money your parents earn from a job in the U.S. is your foreign earned income. This includes money that your parents earn from any job that you do in the U.S. Also, any interest that your father earns on money that you earned while you were away in college is your foreign earned income. Your parents will have to provide a U.S. tax return and other documentation to determine whether the foreign earned income is taxable. (You may be able to deduct some or all of your foreign earned income from your U.S. income tax, although you have to provide the money that your parents earn to you to be eligible for deduction.) Many taxpayers do not pay any federal tax because they file their taxes as head of household rather than filing separately.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Iowa online Form 1098, keep away from glitches and furnish it inside a timely method:

How to complete a Iowa online Form 1098?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Iowa online Form 1098 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Iowa online Form 1098 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.