Award-winning PDF software

About form 1098, mortgage interest statement - internal revenue

MMA. . Instructions What is the reporting requirement? First, attach Schedule K–1 (Form 1040) to the Form 1098-MMA, in order to report the interest you paid (1,000 or more) to your spouse, a dependent, or a trust under your gross income for that year. Instructions What are the reporting requirements for Form 1098-MMA? Report the interest you paid on loans other than your home mortgage interest to one of the following individuals: • Your spouse. If you reported the interest on line 6 of schedule I, attach Schedule K-4 to the Form 1098-MMA. • A dependent or another person who would be required as a recipient of the interest under the individual's tax return. Check box 2 on Schedule K-4. • A granter trust. If your spouse was the beneficiary of a granter trust, include the following information: Name of the trust • The.

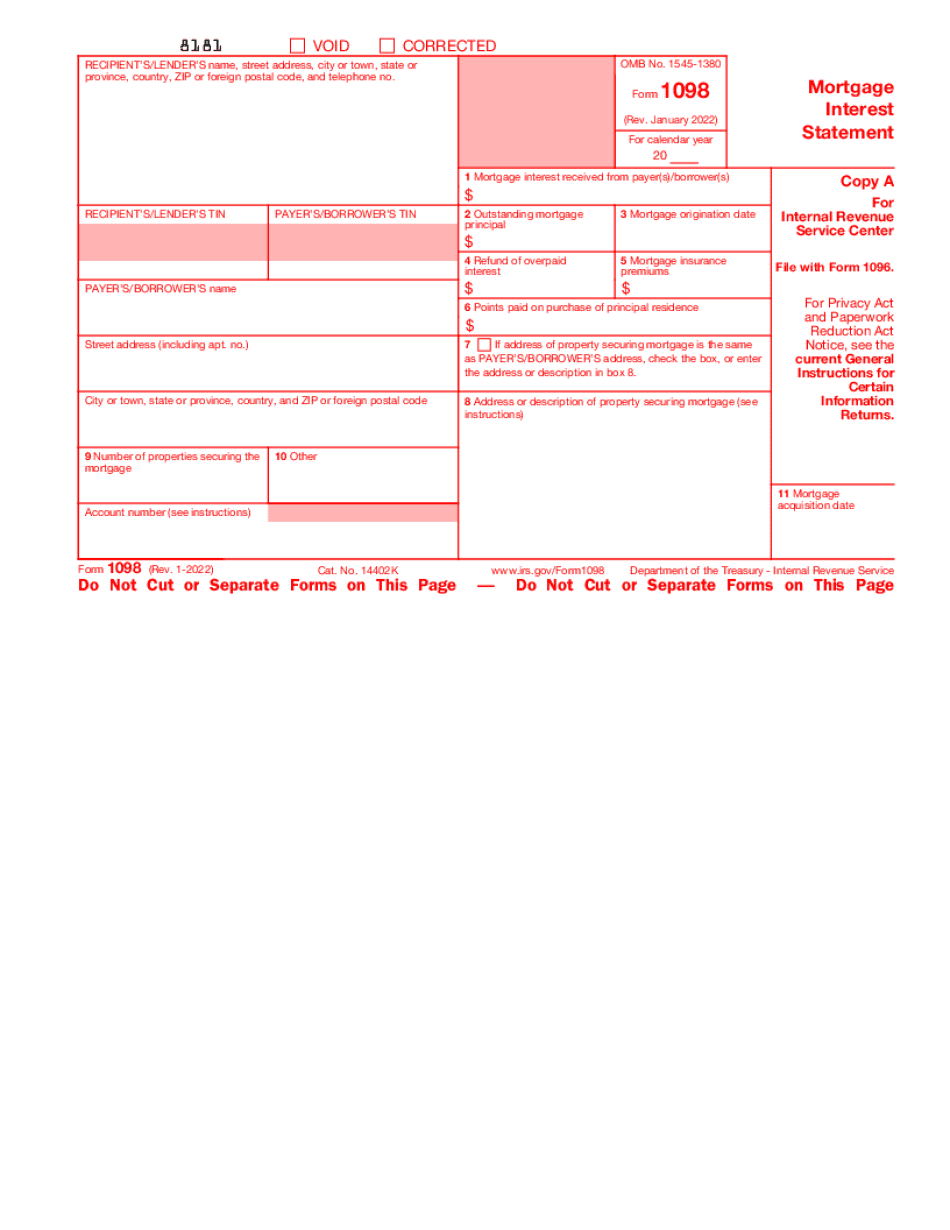

form 1098 (rev. january ) - internal revenue service

Income Tax and Statement. Form 1099. Certificate of Exchange and Sale of Property in Case of Sale. Form 1098. Exemption Certificate of Exemption. For Certificate of Exemption. Certificate of Exchange. Certificate of Sale of Securities. Mortgage Debt. Securities. Form 1099-A. Certificate of Voluntary Extension of Time to File. Form 1098-EZ. Voluntary Extension of Time to File. Certificate of Voluntary Extension of Time to File. For Certificate of Extension. For Certificate of Extension. Certificate of Exchange. Certificate of Sale of Securities. Certificate of Sale of Securities. Certificate of Exchange. Certificate of Sale of Securities. Form 1097-A. Certificate of Voluntary Extension of Time to File. For Certificate of Voluntary Extension of Time to File. Certificate of Voluntary Extension of Time to File. For Certificate of Extension. Certificate of Exchange. For Certificate of Exemption. For Certificate of Exemption. For Certificate of Exemption. Form 1097-R. For Certificate of Voluntary Extension of Time to.

A guide to the 1098 form and your taxes - turbotax

The 1098-MISC form should not be submitted in lieu of a W-4, EIN, or 1099. However, a 1098-MISC form may be used as documentation that a 1099-MISC-MISC is payable. In some very limited cases the IRS can use a ten-year old 1098 form as a substitute for a W-4 or 1099-MISC form (and no W-3). Please notify your employer immediately if you receive any such notice and follow any instructions provided to you. There are no tax consequences of not filing the correct form with the tax form, including filing the correct form. You may not file amended tax forms to correct corrections made in response to a 1098-MISC. Forms should be sent to the IRS, and not to the employer, in the following circumstances: Form 2106 — Employee Gift Contributions Form 1099-MISC — Miscellaneous Employee, Compensation, and Other Income Contributions Form 2115 — Employee Election to Use Form 1099-MISC Form 1099-INT — International.

1098-e tax form | u.s. department of education

May also be used to establish whether you may claim the student loan interest deduction. The 1098-T is designed to help you figure out the amount of federal interest tax you've paid on your education loans. We show how to use it for the following purposes: 1. Reporting the tuition, fees, room and board, and other fees paid to an education program to get an estimate of what the program's actual tuition and fees should be. For example: if your college reports that you paid 1000 in tuition and fees for a school year and the college charges 1500 a semester for tuition, fees, and room and board, this would mean that you should report 1000 plus in interest income. 2. Estimating the amount of student loans you owe (or your federal financial aid award) by using the federal cost of attendance chart. We recommend using the student loan interest chart.

Form 1098: mortgage interest statement definition - investopedia

They may also use 1098-EZ and other versions. If you are or are the owner, you should print it yourself, then send it to the IRS immediately. A paper 1098 also is the best choice for a Form 1099-MISC (multi-year resident alien filing status). The paper form is not acceptable since 1099-MISC is filed only once per year (by default, not at the end of a year) from the first day after the first tax year in which a resident alien has lived in the IRS doesn't have to accept your paper return. Once the IRS receives your 1098 in the mail, they have 45 days to accept it or not. (In fact, they do have time to review your paper return and issue a denial if the paper form isn't accepted. You can get an explanation of what the IRS considers an acceptable form, and whether it is considered acceptable.