Hi, good morning! Eduardo Moran here at an American funding. I just wanted to remind you and also say hi. I hope everything is great. When I give you some of the information, please ensure that when you receive your form 1098, you take it to your tax preparer or CPA. This way, you'll be able to claim back the interest that you paid during this year and get a credit back from the IRS. If you have any questions, feel free to give me a call. I'll be happy to answer any concerns or anything else related to real estate. You can reach me at 567-656-1056. Thank you and have a wonderful day. Bye.

Award-winning PDF software

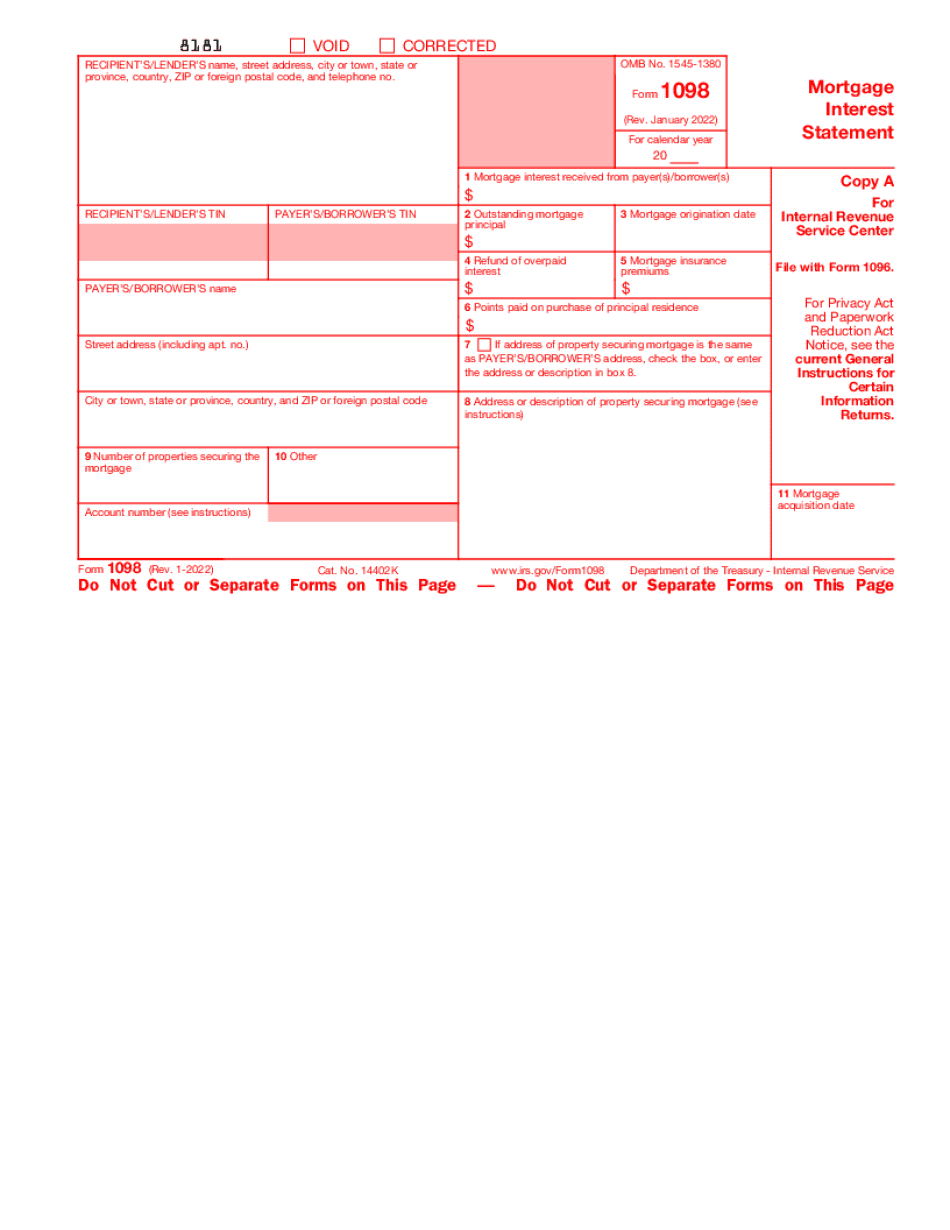

2019-2025 1098 Mortgage Interest Form: What You Should Know

Form — Filed May 12, 2018, Use the IRS Mortgage Interest Statement as a Record of Your Expenses — Intuit Aug 31, 2025 -- A tax form made by a mortgage lender must be filed by the lender to be reported as a debt by the homeowner. The form 1098 mortgage interest statement is a loan document that the lender uses to report mortgage interest. A person who does not have a qualifying mortgage may report the interest expense on a general tax return, or on a Form 1040. Forms — Mortgage Interest Statement and Mortgage Interest -- Filing Software Intuit Sep 28, 2025 -- If your income from interest on a mortgage does not qualify you for federal tax-free income deduction because you don't make enough to reach the limit of 128,000 in 2018, the mortgage interest will be charged to the mortgage interest deduction and is recorded on your Schedule C, Itemized Deductions. F1098 Mortgage Interest Statement 2025 -- TurboT ax Jun 3, 2025 -- A mortgage interest statement for the year 2025 is required of you if you are: the borrower, a co-borrower or the mortgagee. Form 941, Mortgage Interest Statement and Tax Due — TurboT ax Jan 10, 2025 -- Use 2025 federal tax returns for reporting the amount of mortgage interest received, if it exceeds 600. Interest earned on property or a combination of property and interest received through a fixed (fixed-rate, or indexed) rate of interest may be reported on this form. Form 941 Mortgage Interest Statement and Taxes Due — TurboT ax Sep 28, 2025 -- If you receive an amount of mortgage interest from a bank or other lender of 600 or more in payments, include in box 1 on your tax return the bank statement. This is the amount from which you calculated the amount for your tax return. Form 941 Mortgage Interest Statement and Tax Due — TurboT ax Sept 28, 2025 -- Use 2025 federal tax returns for reporting the amount of mortgage interest received, if it exceeds 600. Interest earned on property or a combination of property and interest received through a fixed (fixed-rate, or indexed) rate of interest may be reported on this form. Form 941 Mortgage Interest Statement and Tax Due — TurboT ax Jan 10, 2025 -- Use any return you receive from January 1 to March 31 for reporting the amount of interest received on personal residence (if the property is in your name).

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1098, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1098 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1098 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1098 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2019-2025 Form 1098 Mortgage Interest