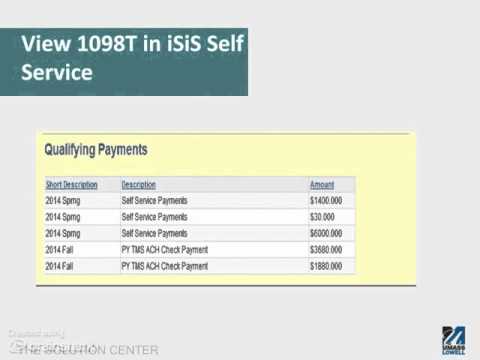

The University of Massachusetts Lowell will issue IRS form 1098-t to each student who was enrolled and has a reportable qualified tuition and related expense during the applicable calendar year information displayed on your 1098-t form will be based on calendar year information January 1st to December 31st it is not based on the semester or academic year the university populates box to amounts billed for qualified tuition and related expenses not box one payments received to view an online version of your 1098-t form log in to Isis by either going to Isis UML edu or visit the tax information section of the new solution Center website paper forms will be postmarked by January 31st each year and mailed to the student's permanent address that is on file in Isis as of midnight December 31st an itemized online version is available for student review via Isis student self-service if the mail 1098-t is misplaced or has not been received the student may use this online version to complete the federal tax return the 1098-t online version reflects how the paper 1098-t statement was completed by the University of Massachusetts Lowell the qualifying charges section found on the online version in Isis itemizes the amounts used to populate box two of the 1098-t form the qualifying payments section in the online version lists all payments made during the reporting calendar year this information is not reported to the IRS the only information reported to the IRS is the information listed at the top in the 1098-t summary section if you need help with Isis or accessing your 1098-t summary page the UMass Lowell solution center is happy to assist please note the university cannot assist you with preparing your tax return please consult with the IRS or a professional tax...

Award-winning PDF software

1098 2019-2025 PDF Form: What You Should Know

Form W982 | IRS The Form W982 is an income tax form used to calculate and report the Federal taxes due on Social Security income, wages and self-employment income earned by a taxpayer ․ Form W-2G | IRS The Form W-2G is used to report employment income you are required to report on Form 1040 when paid by check or money order; reporting your self-employment income (if you are paid by the hour with or without a paycheck or by commission); and reporting interest income on your federal income tax return, unless you are paid at a rate that exceeds the income tax rate for that rate of payment. F.R.C. Sections 1401.11 through 1401.21 | IRS Filing a Federal Tax Return There are two Federal tax return preparers. They both do the same job. They each have their uses, and it is up to you to decide which one you prefer. The first type of return preparer is the personal tax preparer. You call one of these folks at and ask them to prepare your taxes for you, and they will come within a week or two to do so. They will prepare your taxes for you with no extra charges. They will not give you any help in figuring anything out. The other type of tax preparer for you is a partnership, LLC, C corporation, or S corporation that you are involved with. They each give you a separate tax return preparer. You complete your tax return with each of these preparers separately. Tax Return Preparation Form I would recommend that you read this book (you can find the latest edition right here) because it gives detailed instructions on preparing a tax return. This book can be found here. For example, this book will walk you through the process of preparing a tax return from start to finish. For your convenience here are a couple of other tax return preparation guides that you can use to prepare your taxes.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1098, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1098 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1098 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1098 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1098 Form 2019-2025 PDF