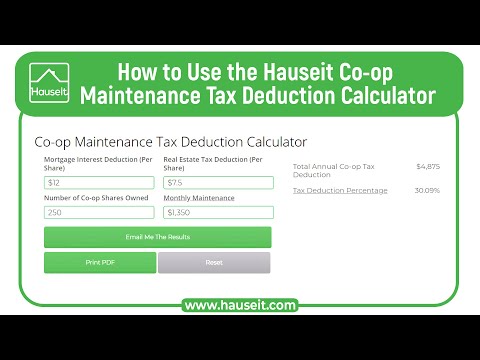

Music today, we're going to walk you through how to use the co-op maintenance tax deduction calculator available at how sitcom. The purpose of the calculator is to figure out what percentage of your monthly maintenance is deductible on your personal income tax return. Customarily, as a co-op owner, also known as a shareholder, you receive an annual co-op tax deduction letter. This letter will specify the per share amounts that you would be able to deduct on your personal income tax, assuming that you itemize deductions on your personal income tax return. The way to compute the deduction is essentially to add the per share interest amount with the real estate tax amount. Take that combined figure and multiply it by the number of shares that you have. Then, you would take that number and divide it by the total annual cotton instead unit. A typical co-op tax deduction percentage in New York City is anywhere from 40 to 50 percent, as the most common figure. Alternatively, it is possible to see one that is higher, perhaps 60 percent or more, or something closer to 30 percent. The extent to which you can deduct these things on your tax return really depends on how much in mortgage interest your co-op is paying. In other words, how much do they have in loan exposure, what is their interest rate, and also how much in real estate taxes they're paying every year. So what you would do is you would go to the calculator here and you would basically just take these figures from the tax deduction letter and plug them into the calculator. So, the interest deduction is approximately three dollars and 51 cents a share, so we would put that in here. And the real estate tax deduction is about thirty-six dollars...

Award-winning PDF software

Co op maintenance tax deduction 2019-2025 Form: What You Should Know

Cooperative housing corporation form, include in the “Other Items” section on Form 1088 if you don't itemize your deductions for the year. It should be 408 (6) Jul 03, 2025 — Cooperative Housing Corporation Form 1088 — If you don't have to worry too much about this date, it may be a good time to do research on co-op housing. Some co-ops may be more profitable than others, You can deduct 500 if you itemize. Cooperative Housing Corporation Form 1088; This tax year, your interest expense is You will receive an IRS 523 (b)(2) form if you sold the property, the property tax deduction is 0.50 and the federal government would have an interest deduction of 0.50 for the same amount of property. If the cooperative's share of the tax reduction is less than 300, your tax deduction is 0, your interest expense is 50¢ and the interest you may be able to deduct is 10¢. If a co-op owns a home worth 3 million and their share of the tax reduction is 300, you would deduct 12,625 (15,000 plus the 250 reduction). If they own a home worth 300,000 and had a tax reduction of 300, you would deduct 5,750 (6,750 minus the 150 reduction). I have been told that a co-op must have tax credits from the state to take credit for property taxes, property maintenance and property taxes paid by a cooperative housing corporation. You can't deduct the mortgage interest on your home if you are a resident of New York. You can deduct the interest paid on your home from time to time. The interest you can deduct is the amount of interest that was in effect at the date you paid rent on the home. You may be able to claim interest and penalties on your mortgage but not the principal amount of the mortgage. If you do not report a co-op information form on Form 1088, you will not be able to deduct your co-op As mentioned above, you can deduct 50% of the monthly co-op loan servicing fee. The loan servicing fee is calculated by multiplying 4.2% of your gross rent by the number of months in the tax year you rent out the house.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1098, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1098 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1098 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1098 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Co op maintenance tax deduction 2019-2025