Hi, my name is Erina DeMarco of Ernest P DeMarco and Associates located in North or New Jersey. I'm here to tell you a little bit about mortgage interest, the new tax law, and how it will affect you. Okay, so the new limit is now $750,000, rather than a million plus a $100,000 worth of equity loan. With the new law, you can have $750,000 in total, anything over that would not be deductible. For a perfect example, if you were to buy a home for $800,000 and you had a $500,000 loan on it, that would be 100% deductible. If you were then to take an equity loan on the house for $250,000, that brings the total loans up to $750,000. You would be able to deduct the entire amount of both loans as long as you use that $250,000 to improve the property. If you were to buy a second home and get a $250,000 loan on that second home property, you would be able to deduct it. However, if you use the equity out of your first property for $250,000 to buy a second home, it would not be deductible. So that loan has to be secured by the property, and that's it.

Award-winning PDF software

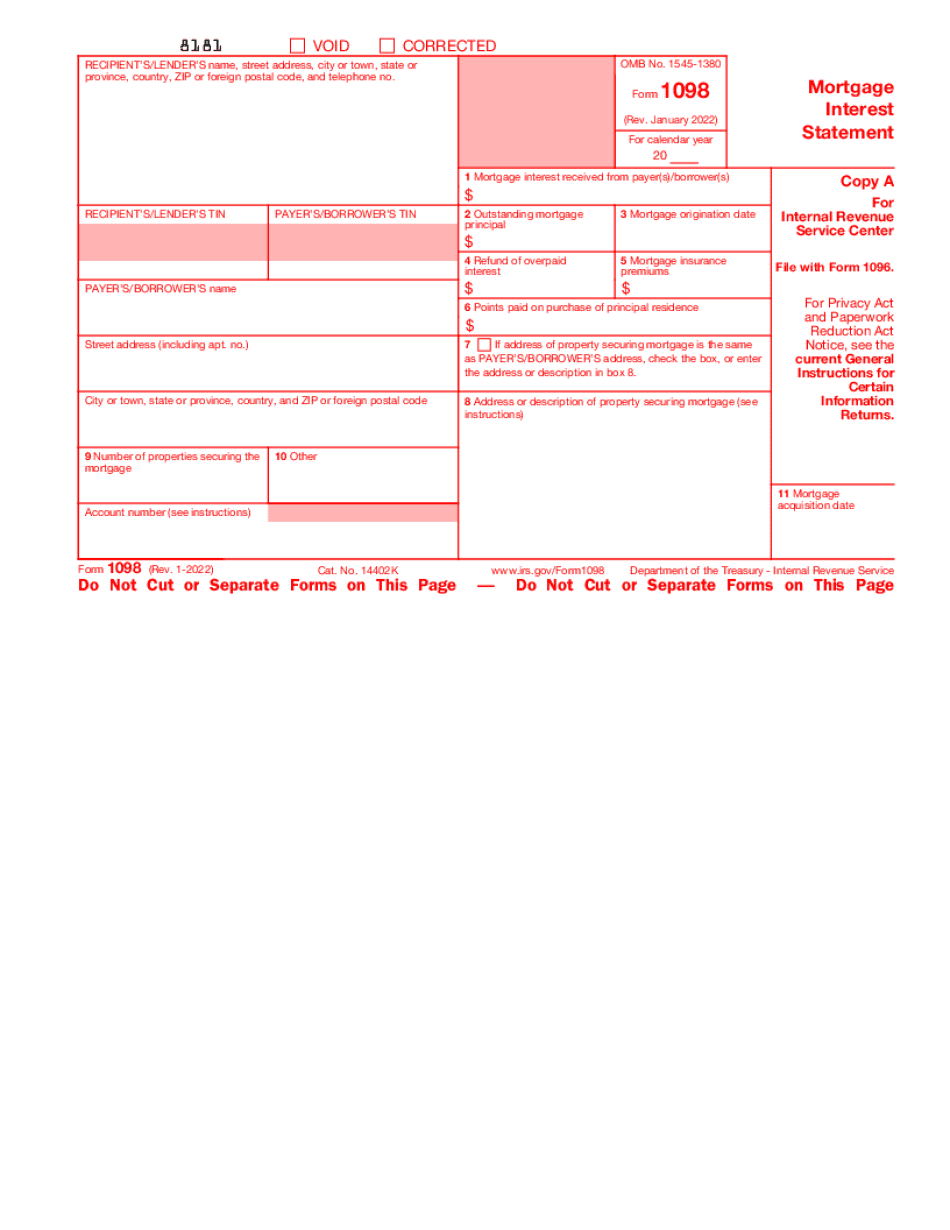

1098 Mortgage Interest 2019-2025 due date Form: What You Should Know

How to Estimate and Use Income from Your Business as Self-Employed Individuals Use the following examples to calculate your self-employment income for 2025 based on if you are a sole proprietor, or you will be self-employed in future year. The Basic Plan You, a sole proprietor, set up your business with the objective of earning a profit. You determine that the business will earn a profit by setting up a limited liability company (LLC) and holding a stock certificate as a shareholder. Since you will have no additional income in the future, you begin selling services such as office cleaning and computer maintenance. You can use the basic plan to determine if you will continue in business. You enter the basics plan as a qualifying plan to calculate self-employment income. A basic plan is the most basic plan you may be eligible for. This plan has no benefits, and no investment income is considered. You must pay no more than the required minimum distribution to your plan account each tax year. There is no limit on the amount of investment income that you have income at all from your plan. You may continue to earn additional income from other investments, such as real estate. However, you can make a maximum contribution to your plan each year. The Limited Use Plan You open the limited use plan for sole proprietors to establish a business and to earn more income and invest. A limited use plan is more restrictive. You are allowed two choices: 1) to invest 10 percent of the value you receive, or 2) to invest more than 10 percent of the value you receive. However, the plan allows contributions of any amount into your plan account at any time. You will need to take a self-employment tax quiz to answer the questions in the basic, limited use plan. The Roth 401(k) Plan The plan allows you to take advantage of the Roth IRA, so that you can accumulate more money that can be used for retirement. A Roth IRA is the most popular plan to contribute to. Many people who use the Roth 401(k) plan choose to put their money in a 401(k) plan and skip the Roth IRA. If you choose to skip this plan, you may be subject to a 10 percent tax on the money you saved. Learn more about how Roth IRAs work and if you need a Roth 401(k) plan before you start your new business.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1098, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1098 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1098 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1098 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 1098 Mortgage Interest 2019-2025 due date