Hi Larry Bass with Mortgage Achievers. You can find me at wwl area on loans at elloans.com. I had a question, Larry. Is it better to pay a higher interest rate and deduct it for tax purposes, even though I'll be paying more in mortgage interest in the long run? Let's use an example to answer that question. Let's say we have a $175,000 loan with a current interest rate of 5.5%. The monthly principal and interest payment for this loan is approximately $993. Now, let's say we lower the interest rate to 4.75%. With this lower rate, the monthly principal and interest payment becomes $912, saving you $80 per month or around $960 per year. The question now is, will I save that amount in interest if I have the higher rate loan versus the lower rate loan? Let's use some numbers to find out. With the 5.5% interest rate, you will pay $9566 in interest only over a 12-month period, and your principal balance will be reduced to $23,558. With the 4.75% interest rate, you will pay less in interest and more towards the principal, resulting in a lower remaining balance, around $27,700 (175,000 - 23,558). Now, let's consider the tax savings or deductions on your schedule A of your 1040. We will use the estimated property taxes of $1,500 per year and a hazard insurance cost of $1,400 per year (combined total of $2,900). I have rewritten these numbers for clarity. The principal and interest for the 5.5% rate is $995.66, and for the 4.75% rate is $912. I included the estimated property taxes and hazard insurance costs to both scenarios. [Continued in the next message.

Award-winning PDF software

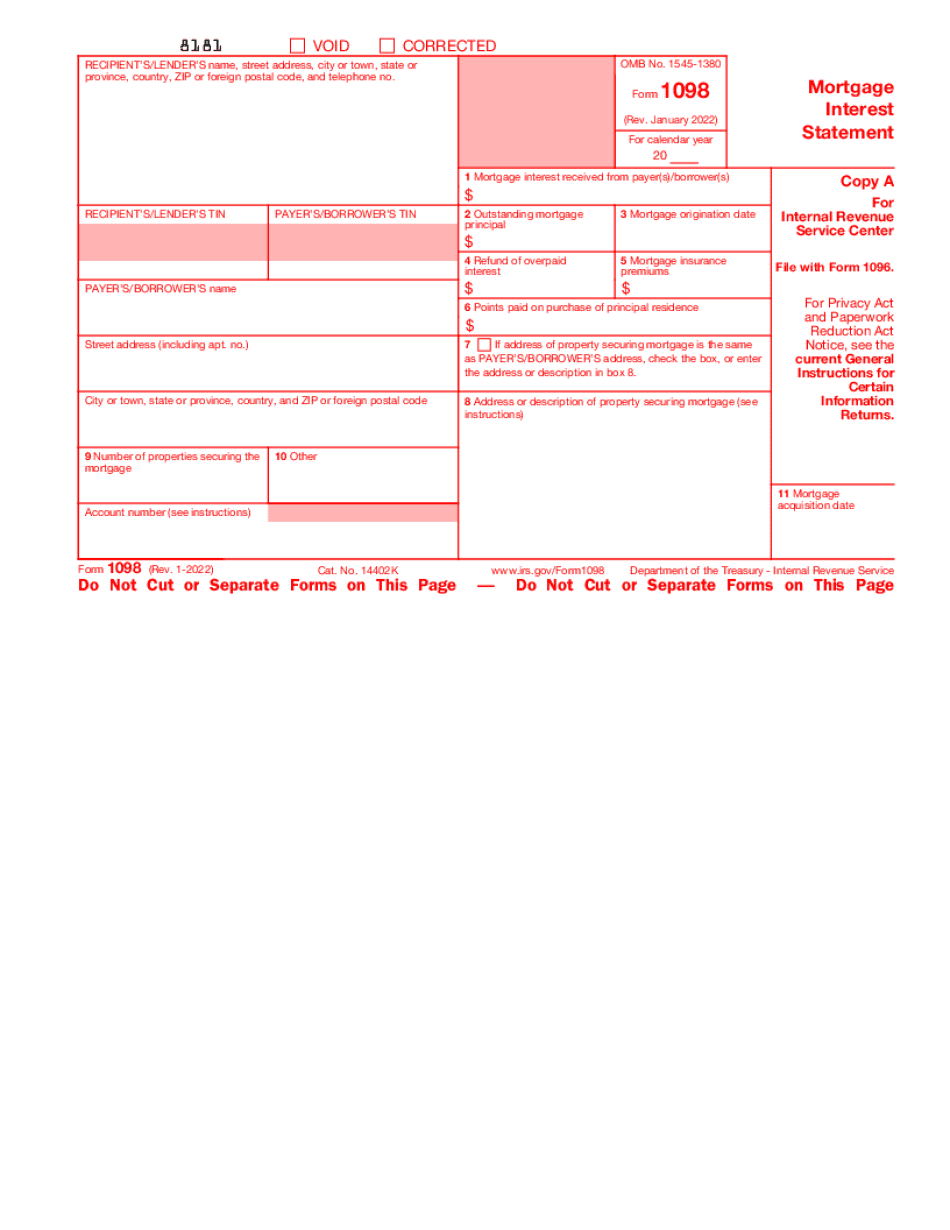

1098 Mortgage Interest 2019-2025 Form: What You Should Know

If you make payments this tax year, you may be eligible to deduct up to 2,500 in interest you paid on your loans. For more info on the If you are not eligible, you may want to contact your lender about the cost of making payments. For more information, please contact the A Guide to the 1098-E Forms and Your Taxes — TurboT ax 1098-E, Student Loan Interest Statement. If you made federal student loan payments in 2020, you may be eligible to deduct a portion of the interest you paid If you make payments this tax year, you may be eligible to deduct up to 2,500 in interest you paid on your loans. For more info on the If you are not eligible, you may want to contact your lender about the cost of making payments. For more information, please contact the 1098 is a tax form for reporting and paying back taxes to the IRS about interest on mortgages. The 1098 is a form that you may use if your income is high enough, and you're required to file a tax return. You can request the form by completing the 1099-Misc, Bankruptcy Interest Statement — IRS 1099-Misc, Bankruptcy Interest Statement (Revised). For tax purposes, a bankruptcy means you went into arrears on your debts, and the debts are not yours. 1099-Misc, Bankruptcy Interest Statement (Revised). For tax purposes, a bankruptcy means you went into arrears on your debts, and the debts are not yours. 1099-PAY, Form 1099-PAY (Purpose of Payment for Services). Form 1099-PAY is used by lenders to report interest and fees paid by the borrower if the total amount is 800 or more. 1099-RISC, Mortgage Interest Statement — IRS 1099RISC, Mortgage Interest Statement: Revised. For tax purposes, a bankruptcy means you went into arrears on your debts, and the debts are not yours. 1099RISC, Mortgage Interest Statement: Revised for Tax Purposes. This is a revised version of a 1099-RISC form used for tax purposes. 1099-RISC, Mortgage Interest Statement: Revised (Purpose of Payment for Services). This Form is used if the amount reported is 800 or more, and you are required to file tax return.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1098, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1098 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1098 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1098 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 1098 Mortgage Interest 2019-2025